![]() Research Methodology

Research Methodology

Blue Wealth's research methodology has been developed by a team of industry professionals and combines years of experience, study and analysis. It is the country's most comprehensive, up-to-date research methodology.

Our research methodology adopts a 'macro to micro' approach and has four steps:

Step one - Market timing

This step uses historical price data to determine a property markets position in its cycle together with forward looking gauges of a markets potential for capital gain such as growth in sales volumes, investor lending and supply and demand analysis

Step two - Macro research

This step uses macro economic analysis to identify geographical regions that are likely to experience strong capital growth. Our research indicates that the following factors impact the property market.

Step three - Micro research

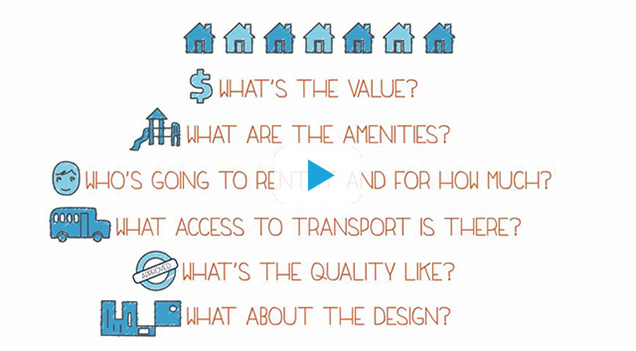

Once a region has been identified as having strong growth potential, Blue Wealth's process of micro research is then conducted. Our micro research analysis includes:

Step four - Blue Wealth index

Every property is then rated on a scale of 1-10 for its potential in:

Growth is the key for creating long term wealth, however we recognise that many clients are sensitive to cash flow and as a result Blue Wealth only approves properties that have scored at seven or above for both these categories. The Blue Wealth Index provides investors with a simple way to compare investments and ensure they acquire properties most suitable for their portfolio.

The Research Model

Research Blogs

How to find the right property

RESEARCH METHODOLOGY AUDIT REPORT